Grant Of Probate And Letters Of Administration

Home Areas of Practice

Estate Law

Grant Of Probate And Letters Of Administration

Grant Of Probate And Letters Of Administration

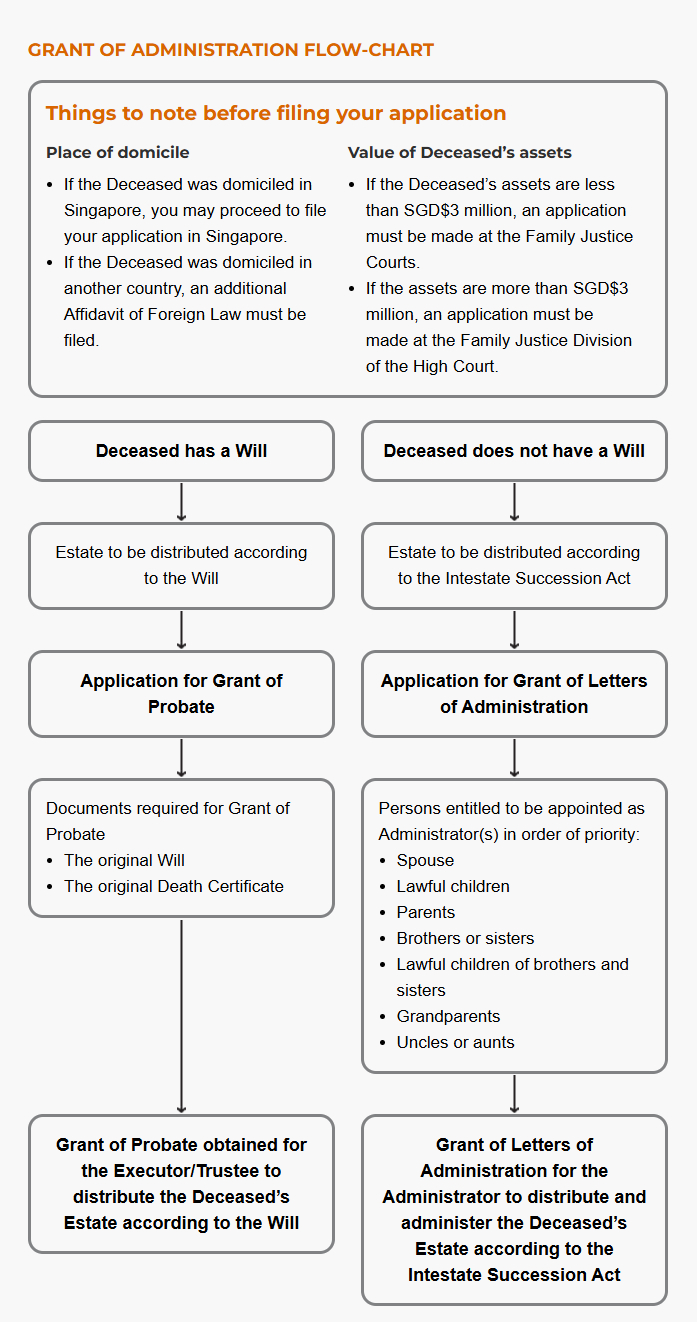

In Singapore, probate is a court process whereby, amongst others, persons are appointed to manage and distribute the estate of a deceased person according to their will, or in the absence of a will, Singapore intestacy laws.

The Grant of Probate serves as confirmation that the will is valid and recognized as the final will of the deceased.

If the deceased did not leave a will, we can also assist with applying for Letters of Administration and guide you through the process of administering the estate.

At Gloria James-Civetta & Co, we make the process of distributing the estate of your loved ones simple and hassle-free as possible. We offer fixed-fee services for straightforward cases, to help you obtain Grant of Probate & Letters of Administration in an expedited and cost-effective manner.

Contact us today to find out how we can assist you.

Grant of Probate

In Singapore, the distribution of a deceased person’s estate should be carried out according to their expressed wishes as outlined in their will. The individuals responsible for ensuring this happens are known as executors, and they are typically named in the will itself.

To fulfill their duties, the executors must submit specific legal documents to the Court to apply for a Grant of Probate. This grant is a legal authorization from the Court that allows the executors to manage and distribute the estate in accordance with the deceased’s will.

Applying for a Grant of Probate

Before completing an application for Grant of Probate, one thing to check is whether the will either implies or expressly states who the executors are to be. The formal requirements for the validity of a will must also be satisfied.

The grant of probate should be applied for within six months from the date of death of your loved one. Our probate lawyers can assist you by filing an originating summons alongside the relevant documents required for making the application.

Letters of Administration

Where there is no will, or the will of the deceased is otherwise found to be invalid, a spouse or other next of kin of the deceased must apply to the Court to be appointed the deceased’s personal representative and administrator of the estate. The process for appointing an administrator(s) is known as Grant of Letters of Administration.

Applying for Letters of Administration

Letters of Administration authorise an appropriate person to be appointed as an administrator and to distribute the estate of the deceased in line with Singapore intestacy laws, in particular the Intestate Succession Act.

The Intestate Succession Act sets out seven classes of persons who are entitled. In order of priority, these are:

- the spouse;

- the children of the deceased;

- the parents;

- brothers and sisters;

- nephews and nieces;

- grandparents; and,

- uncles and aunts.

Where any of the beneficiaries of the estate are aged under 21 years of age, two or more administrators must be appointed.

Resealing of Probate in Singapore

In Singapore, a “Reseal of Probate” is a process that allows a grant of probate or letters of administration issued in another jurisdiction to be recognized and used within Singapore. It is particularly relevant when the deceased owned assets in Singapore but the original probate was granted overseas.

By obtaining a Reseal of Probate, the executor or administrator is legally authorized to manage and distribute the Singapore-based assets as if the probate had been originally granted here.

To apply for a Reseal of Probate in Singapore, the executor or administrator must submit a formal application to the Singapore High Court. This application should include the original grant of probate or letters of administration from the foreign jurisdiction, along with other supporting documents.

Once the reseal is granted, the executor can proceed with handling the deceased’s assets in Singapore, ensuring that the estate is managed and distributed according to the wishes outlined in the will or the applicable country’s intestacy laws.

Ensuring Compliance with Singapore’s Probate Laws

Many organizations, such as banks, financial institutions and property registries, require sight of this grant before allowing the executor or administrator to manage the assets. If the original Grant of Probate was issued outside Singapore, resealing it in Singapore confirms its validity here.

Once the Singapore High Court reseals the Grant of Probate, it is recognised as if it were initially granted in Singapore, ensuring that all relevant entities accept it for the administration of the estate within Singapore.

Our experienced estate lawyers and administrators can explain your responsibilities and assist to obtain formal administration (Probate & Letters of Administration) from the Singapore Courts to be able to manage and distribute the estate’s assets to the intended beneficiaries.